Across a typical 10-store operation, your service departments generate roughly $4.2 million in annual gross profit. EVs could cut that in half. Meanwhile, your SEO agency is probably charging you $15,000+ monthly while missing the biggest opportunity in automotive digital marketing.

After 20+ years specializing exclusively in automotive SEO, we’ve seen what most agencies won’t tell you: the way EV buyers search is fundamentally different from traditional car buyers, and if your agency isn’t adapting your strategy accordingly, you’re leaving millions on the table.

Here’s the uncomfortable truth about EV search traffic that most agencies either don’t understand or won’t admit.

The Dirty Secret: Most SEO Agencies Don’t Understand Automotive (Let Alone EVs)

Let’s start with something your current agency probably won’t mention during your monthly reporting call.

Generic digital marketing agencies treat car dealerships like any other local business. They apply the same playbook they use for restaurants, lawyers, and plumbers. They optimize for “[City] car dealership” and call it a day.

According to Cox Automotive’s 2024 Car Buyer Journey Study, EV buyers spend 13+ hours researching online before making purchase decisions, nearly double the time traditional car buyers spend. Research from Google’s Automotive Ads Study shows that 95% of car buyers use digital as a source of information, but EV buyers take this to an extreme.

EV buyers aren’t just searching differently. They’re searching for completely different things.

What Traditional Car Buyers Search For:

- “[Make] [Model] [City]”

- “Best price on [Vehicle]”

- “Car dealerships near me”

What EV Buyers Actually Search For:

- “Real-world range [EV Model] winter driving”

- “Home charging installation cost [State]”

- “Which EVs qualify for tax credit 2025”

- “Should I buy EV or plug-in hybrid”

- “EV maintenance costs compared to gas”

Your generic SEO agency is optimizing for the first list. EV buyers are searching the second list.

And here’s the kicker: EV buyers spend significantly more time in the education phase compared to traditional car buyers. By the time they’re searching for inventory, they’ve already formed strong preferences.

Red Flag #1: Your Agency Thinks “EV SEO” Means Optimizing Your Inventory Pages

Most agencies’ “EV strategy” consists of:

- Adding EV inventory pages to your website

- Optimizing for “[Brand] EV dealer [City]”

- Maybe adding “electric vehicles” to your homepage

That’s not an EV strategy. That’s the bare minimum.

According to Think with Google’s research, consumers engage with multiple information sources throughout their purchase journey, with search playing a crucial role in the consideration phase, long before they’re ready to search for inventory.

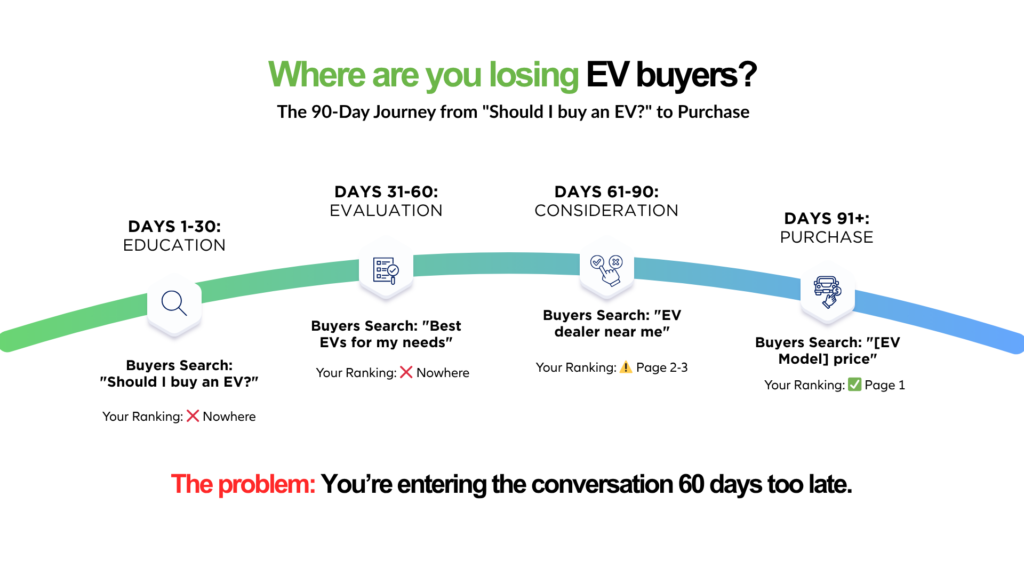

The EV Buyer Journey Nobody’s Optimizing For:

Days 1-30: Education Phase

- Searching: “Should I buy an EV,” “EV pros and cons,” “How does EV charging work”

- Where your agency has you ranking: Nowhere

Days 31-60: Evaluation Phase

- Searching: “[EV Model] real owner reviews,” “Best EVs for [climate]”

- Where your agency has you ranking: Nowhere

Days 61-90: Consideration Phase

- Searching: “Test drive [EV Model] near me,” “[Brand] EV dealer [City]”

- Where your agency has you ranking: Maybe page 2-3

Days 91+: Purchase Phase

- Searching: “[Specific EV] price [City]”

- Where your agency has you ranking: Hopefully page 1

The problem? Your agency is only targeting Days 61+, after the buyer has already formed preferences and visited your competitors’ websites.

The opportunity? Strategic local SEO that captures buyers in Days 1-60, while they’re still forming opinions.

Red Flag #2: They’re Not Tracking the Metrics That Actually Matter

Pop quiz: Ask your SEO agency these questions during your next call:

- “What’s our ranking for ‘how to charge [EV Model we sell] at home’?”

- “How much organic traffic are we getting from EV educational searches?”

- “What’s our cost-per-EV-lead from organic search versus paid search?”

If they can’t answer these immediately, they’re not tracking the right metrics.

Most agencies report on vanity metrics:

- “Your organic traffic increased 23%!” (From what? Bot traffic?)

- “You’re ranking #3 for ‘[City] car dealership’!” (How many EV leads did that generate?)

- “Your domain authority improved!” (How does that impact my bottom line?)

What Actually Matters for EV Search Strategy:

According to WordStream’s 2024 automotive industry benchmarks, automotive keywords average $2.46 per click, though highly competitive EV terms in major markets can cost significantly more. For a multi-store operator generating 200 EV leads monthly through paid search, even at average CPCs with a 3% conversion rate, that’s nearly $200,000 in annual ad spend that could be reduced through strategic organic search optimization.

Meanwhile, BrightEdge research shows organic search drives over 50% of website traffic and typically converts at higher rates than paid channels.

Your agency should be showing you exactly how much money you’re saving by NOT paying for clicks on EV terms. If they’re not, they don’t understand the business case for SEO.

Red Flag #3: They’re Using a “Set It and Forget It” Approach

Here’s a question most agencies hate: “What have you actively optimized or improved in the past 30 days?”

If the answer is “we published 4 blog posts” or “we built some backlinks,” that’s not an active EV search strategy.

What EV Search Actually Requires:

Constant Content Adaptation:

- Federal tax credit rules change annually (requiring content updates)

- New EV models launch quarterly (requiring new optimization)

- Charging infrastructure expands (requiring local content updates)

- State incentives change (requiring regional content adjustments)

According to the U.S. Department of Energy’s Alternative Fuels Data Center, EV adoption rates and incentives vary dramatically by state and evolve constantly. Your content strategy needs to reflect these changes or you’re providing outdated information that tanks your credibility and rankings.

Technical SEO That Most Agencies Miss:

According to Moz’s Local Search Ranking Factors study, multi-location businesses face unique technical SEO challenges. Most agencies don’t properly handle:

- Location-specific EV inventory pages (avoiding duplicate content penalties)

- Structured data markup for EVs (vehicle schema with electric-specific attributes)

- Local service area optimization (charging installation service areas)

- Cross-location content architecture (centralized learning hub vs. localized inventory)

If your agency isn’t actively managing these technical elements across your portfolio, you’re getting penalized in search rankings daily.

Understanding how to coordinate local SEO across multiple locations is fundamentally different from single-location optimization, and most agencies simply apply single-location tactics across your entire network, which doesn’t work.

Red Flag #4: They Don’t Understand the EV Buyer’s Actual Concerns

Generic agencies create content based on keyword research tools. That’s fine for basic SEO, but it completely misses the psychological barriers EV buyers are trying to overcome.

What Keyword Tools Show:

- “EV range” (high search volume)

- “EV charging” (high search volume)

- “EV price” (high search volume)

What EV Buyers Actually Want to Know:

- “Will I make it to my mom’s house 200 miles away in winter?” (range anxiety)

- “What if I’m stuck in traffic with the heat on?” (real-world scenarios)

- “How much will my electric bill increase?” (total cost of ownership)

- “Can I charge it at my apartment?” (practical barriers)

See the difference? Keyword tools show search terms. Understanding automotive consumers shows the underlying anxiety behind those searches.

Your generic SEO agency writes: “The Ford F-150 Lightning has a range of up to 320 miles.”

What actually ranks and converts: “Will the Ford F-150 Lightning Make It Through a Minnesota Winter? Here’s What Real Owners Say About Cold Weather Range.”

The second headline addresses the actual fear. It provides social proof. It’s specific to regional concerns. That’s what ranks. That’s what converts.

Red Flag #5: They’re Ignoring the Multi-Store Competitive Advantage

If you operate multiple locations, you have a massive competitive advantage in EV search that single-store dealers can’t match. Most agencies don’t leverage this at all.

The Multi-Store SEO Multiplier Effect:

When you properly coordinate SEO across multiple locations:

- Organizational Authority Compounds: Google recognizes your brand as a regional EV authority

- Content Investment Scales: One piece of quality EV content serves all locations (amortized cost)

- Backlink Power Multiplies: Links to your brand benefit all locations

- Technical Excellence Replicates: Fix one location’s technical issues, replicate across all stores

- Data Insights Improve Faster: More locations = more traffic data = faster optimization

According to Google’s Core Web Vitals documentation, site performance affects rankings. For multi-store operators, implementing technical improvements across your network creates compound returns that single-store dealers can’t achieve.

But here’s what we see constantly: agencies treat each location as a separate project, creating duplicated effort, inconsistent quality, and missed synergies.

A properly coordinated multi-store EV search strategy should cost LESS per location than single-store optimization while delivering BETTER results. If your agency charges you linearly by location, they don’t understand scale advantages.

The Real Cost of Getting EV Search Strategy Wrong

Let’s talk about what this actually costs you.

Scenario: 10-store operation in competitive markets

Current State (Generic SEO Agency Approach):

- Monthly agency fee: $12,000-15,000

- Paid search for EV traffic: $50,000-60,000/month

- Organic EV lead generation: Minimal (15-20 leads/month total)

- Annual cost: $744,000-900,000

Optimized State (Automotive-Specific EV Strategy):

- Monthly SEO investment: $15,000-20,000

- Paid search for EV traffic: $15,000-20,000/month (70% reduction)

- Organic EV lead generation: 150-200 leads/month (10x increase)

- Annual cost: $360,000-480,000

Net annual savings: $360,000-420,000

But here’s what that doesn’t capture:

Hidden Costs of Poor EV Search Strategy:

- Lost market share: Competitors ranking for EV education capture buyers in your territory

- Higher CAC over time: As EV adoption grows, paid search costs increase while organic costs stay flat

- Diminished brand authority: When competitors own EV content, they become the trusted source

- Service revenue decline WITHOUT offsetting lead gen improvement: You face both problems simultaneously

For a 10-store operation, the difference between getting EV search right versus wrong could represent $2-3 million in impact over three years.

Questions to Ask Your Current Agency (Your BS Detector)

Here’s how to know if your agency actually understands EV search strategy:

Question 1: “Show me our rankings for EV educational searches, not just inventory terms.”

Good answer: They pull up rankings for 50+ EV educational keywords with monthly tracking.

Bad answer: “We focus on purchase-intent keywords” or “Let me get back to you on that.”

What it means: They’re not capturing buyers until they’re already comparison shopping.

Question 2: “How much are we spending on paid search for EV terms we should rank for organically?”

Good answer: Detailed breakdown showing paid spend by keyword category with specific opportunities and projected savings.

Bad answer: “Paid search and SEO are separate strategies.”

What it means: They don’t understand the business case for SEO.

Question 3: “How are you coordinating SEO across our 10 locations to maximize efficiency?”

Good answer: Explanation of centralized content hub strategy, standardized technical implementations, and location-specific customization.

Bad answer: “We treat each location as its own project.”

What it means: They don’t understand multi-location scale advantages and you’re paying for duplicated effort.

The Bottom Line: What This Means for Your Operation

The EV transition is reshaping dealership profitability. According to NADA’s 2024 Dealership Financial Profile, service departments generate 49% of gross profit. For a 10-store operation, that’s $4.2 million in annual service profit at risk.

But here’s what most dealers and most SEO agencies are missing:

While service revenue declines, customer acquisition costs are rising. According to WordStream’s benchmarks, competitive automotive keywords cost $15-20 per click and climbing.

The opportunity: Capture EV buyers through organic search at dramatically lower cost while competitors keep writing bigger checks to Google.

The challenge: Your generic SEO agency doesn’t know how to do this because they don’t understand automotive, don’t understand EV buyer psychology, and don’t understand multi-location scale advantages.

You didn’t build a 10-store operation by accepting mediocre performance from vendors. You built it by recognizing what works, testing systematically, and scaling proven strategies.

Your EV digital strategy deserves the same approach.

The dealers who successfully navigate this transition won’t be those who spent the most on SEO. They’ll be those who worked with agencies that actually understand automotive, EV buyer behavior, and how to build search strategies that capture buyers 90 days before purchase instead of 90 seconds before.

See What Your Current Agency Is Missing

Want to know what your current SEO agency isn’t telling you about your EV search performance?

We’ll run a complimentary competitive analysis showing:

- Where you actually rank for EV educational searches (not just inventory terms)

- How much you’re spending on paid search for terms you should rank for organically

- What EV content your competitors have that you’re missing

- Specific technical issues affecting your multi-location EV visibility

- Projected savings from proper EV organic search strategy

We’ve spent 20+ years working exclusively with automotive dealerships. We understand the business model, the buyer psychology, and the technical strategies that actually work for multi-store operations. Learn more about our automotive-specific approach.

Ready to see what your current agency isn’t telling you? Let’s talk.

Tim Boyle

How We Run a Dealership Competitor SEO Audit (And Why Most Dealers Skip the Steps That Actually Matter)

A3 Brands Wins Best Linear Booth at NADA Show 2026

How We Help Dealers Prove SEO ROI in Test Drives and Units Sold

When Local SEO Beats PPC: A Dealership Decision Framework

SEO to Showroom: How We Connect Organic Search to Actual Car Sales