We’ve talked to dozens of dealers this year with the same story.

Website traffic dropped. Fewer leads in the CRM. Fewer phone calls. Fewer people walking onto the lot saying “I found you online.”

Meanwhile, ad costs keep climbing. Dealers spend more to get the same results they used to get for free.

If this sounds familiar, you’re not imagining it. We’re seeing it everywhere.

Google Changed the Rules

We started noticing the shift 18 months ago.

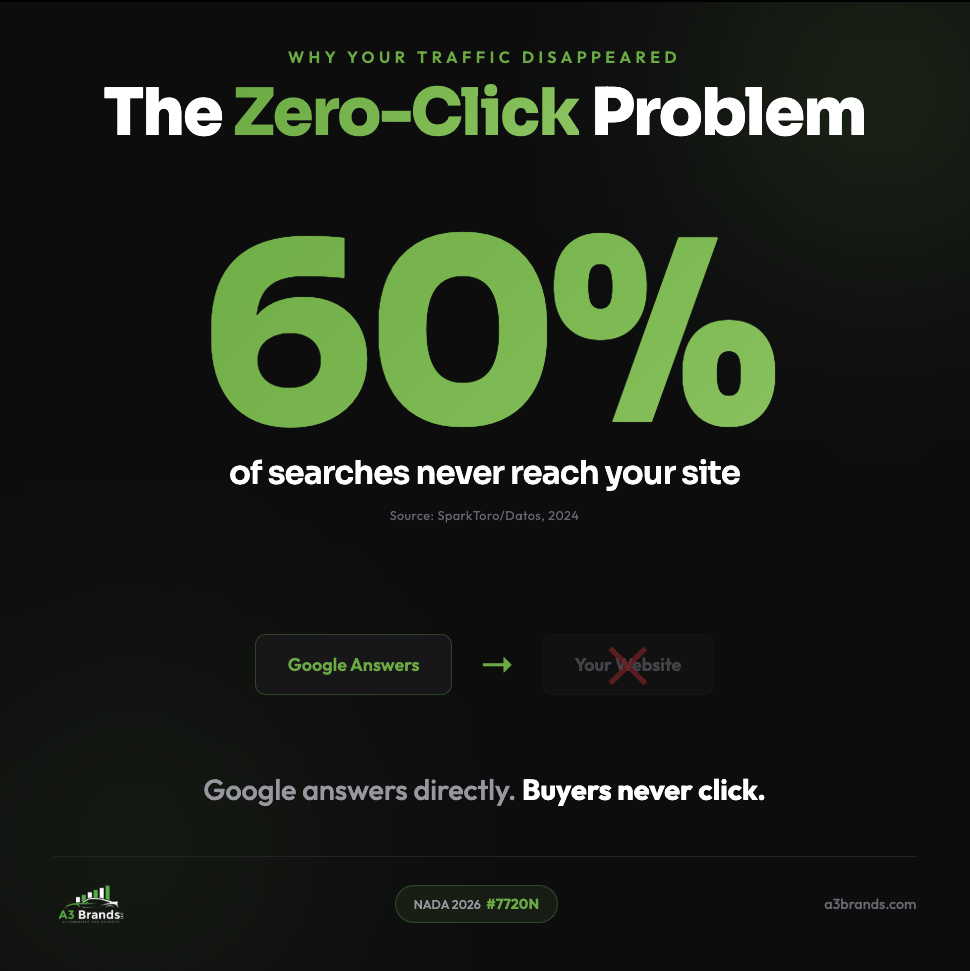

Sixty percent of Google searches now end without a click. Google answers questions directly on the search page. Buyers never make it to your site.

Google also overhauled its ranking algorithm six times in that period. Sites that ranked well in 2023 are now invisible.

We’ve watched dealerships go from page one to page three without changing anything. The rules changed underneath them.

The dealers still showing up? They adjusted. They publish content Google rewards.

The ones who didn’t? They’re paying for every click they used to get for free.

Your Competitors Are Taking Your Customers

Here’s what we see happening in every market we analyze.

Ninety-five percent of car buyers research online before setting foot on a lot. They spend 14+ hours comparing dealers within driving distance.

When someone searches “best dealership near me” or “new trucks in [your city],” who shows up first?

We run these searches for dealers every week. The results surprise them. Competitors they underestimated dominate the first page.

Those buyers aren’t comparison shopping when they arrive. They’ve already decided. The dealership that showed up first earned their trust before the test drive.

The Ad Spend Trap

We hear the same response from dealers who notice the drop: “I’ll just spend more on ads.”

Average dealership ad budgets hit $543,539 last year. That number climbs every year.

But here’s what we tell every dealer we work with.

Organic traffic costs you nothing per click. Every buyer you lose from organic costs 2-3x more to replace with paid ads.

Dealers who rank well aren’t spending less on marketing. They’re getting more for what they spend. Their website works the night shift for free while competitors pay per click.

Why Your Website Stopped Working

We’ve audited hundreds of dealership websites. The same problems show up on almost every one.

Here’s what we found at a Toyota store last quarter.

Their “New Camry” page hadn’t been updated since 2022. Same thin description. Same stock photo. Meanwhile, a competitor 15 miles away was publishing monthly content. Camry vs. Accord comparison guides. “Best Camry trim for families.” Local road trip features.

Google looked at both sites and made a decision: one dealership is an active, helpful resource. The other is a digital brochure collecting dust.

Guess which one shows up first.

Google now rewards three things:

Signs of life. Updated pages. New content. Proof you’re open for business, not just open for business in 2019.

Owning your backyard. Content that proves you know your market. Your roads, your buyers, your inventory. Not generic copy that could apply to any dealer in America.

Real answers. Original content that helps buyers make decisions. Not manufacturer descriptions your competitors also copied and pasted.

Most dealership websites we audit haven’t published anything meaningful in months. That’s not an SEO problem. That’s a visibility problem. And it’s why someone else is getting your ups.

What This Costs You

We calculate this number for every dealer we work with.

If organic traffic dropped 20% this year, that’s 20% fewer free opportunities to sell a car.

Multiply that by your average gross profit per unit. That’s money walking onto your competitor’s lot.

Over 12 months, that number gets painful. We’ve seen dealers lose six figures in potential gross profit from organic decline alone.

We’re Going to Fix This

This is the first post in a six-part series leading up to NADA 2026.

Over the next six weeks, we’re answering the questions dealers keep asking us:

“Why do my competitors keep showing up first?” We’ll show you exactly what they’re doing differently. It’s probably not what you think.

“What’s another year of this actually going to cost me?” We’ll run the real numbers. They’re worse than most dealers expect.

“Why hasn’t my current SEO vendor fixed this?” Because most of them are still playing by 2019 rules. We’ll explain what changed.

“What actually works now?” We’ll break down the content system that’s helping dealerships own their local market on Google.

“What’s GALAXY?” That’s what we’re unveiling at NADA. And it changes everything.

One Thing to Do Right Now

Pull up Google. Search for your brand dealership plus your city name.

Count how many times a competitor shows up before you do.

That’s your problem. And your opportunity.

We run free competitive analyses for dealerships. No pitch.

Just data showing exactly where you stand and what it would take to close that gap.

Reach out and we’ll send it over.

Next week: Why Your Competitors Keep Showing Up First on Google

About A3 Brands

A3 Brands is an automotive-only digital marketing agency. We don’t work with dentists, lawyers, or HVAC companies. Just dealerships. 42 of them across the country.

We’ll be at NADA 2026 in Las Vegas (February 3-6) unveiling GALAXY, our AI-powered content system built to keep your dealership in front of every buyer searching your market.

Stop by Booth #7720N or request a free competitive analysis at https://a3brands.com/galaxy/.

Tim Boyle

SEO to Showroom: How We Connect Organic Search to Actual Car Sales

How We Cut Dealership CAC 42% Through Organic Search (And You Can Too)

How to Optimize Model Landing Pages for Dealership SEO

ASC Implementation: How We Cut Dealer PPC Waste by Exposing What Organic Already Captures

Model Landing Page SEO: Stop Burning Budget on Pages That Don’t Convert